Planning a company retreat is a meticulous process that involves careful consideration and attention to detail. From choosing the right destination to crafting a meaningful itinerary and setting achievable goals, each step plays a vital role in ensuring a successful and productive retreat.

Choosing a Destination

Selecting an appropriate destination is the foundational step in planning a successful company retreat. The destination should align with the goals and objectives of the retreat while catering to the preferences and interests of the team members. Whether it’s a serene countryside escape, an adventurous mountain retreat, or a coastal beachfront, the destination should offer an environment conducive to team bonding, relaxation, and productive discussions. When considering a destination, you should also consider the logistics of travel. How much time and money will your team have to invest in traveling? Should you look for locations that are close to your company’s headquarters or somewhere further away? You should also ensure that all transportation options and accommodations are within budget and have proper safety protocols in place. By following these steps, you’ll have a better chance of selecting the perfect destination for your company retreat. With the right location, your team will be able to make the most of their time away and come back feeling truly refreshed and reconnected.

Developing an Itinerary

Crafting a well-rounded itinerary is crucial to maximizing the benefits of a company retreat. The itinerary should strike a balance between structured activities, team-building exercises, and opportunities for free time and relaxation. Incorporating outdoor exploration can provide a refreshing break from the routine and allow team members to connect with nature. Engaging in team hikes, outdoor games, or simply enjoying the natural surroundings can foster camaraderie and rejuvenate the team’s spirit. Hiring a tour guide can mean less planning to think about before the trip. When planning the agenda, include time to discuss the upcoming year’s goals and strategy. This can be a great opportunity for team members to work together on brainstorming activities and establish collaborative goals. Activities that encourage creative problem-solving and friendly competition can also help to build morale within the group. With a little bit of creative planning, the team will come away from the retreat feeling motivated and inspired.

Creating Goals

Establishing clear and achievable goals for the company retreat is essential to ensure that the time spent together is purposeful and productive. These goals should be aligned with the overall objectives of the organization, whether they focus on team building, strategic planning, or fostering creativity and innovation. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART) to provide a clear direction for the retreat. The team should come together to agree on the common goals prior to the retreat. This will provide everyone with a clear understanding of the intended outcomes and expectations from the event. It is also important for management to understand what each team member hopes to gain from the experience as this can help ensure that all participants are motivated and feel valued throughout the event. With well-defined goals in place, the retreat can progress in an organized and efficient manner.

By carefully considering these aspects, a well-planned company retreat can be a transformative and enriching experience for the team, fostering stronger relationships and contributing to the overall success of the organization.

Did You Enjoy Reading This Article? Here’s More to Read: Event Planning Tips Every Business Owner Needs to Use

OK I will admit I am a huge offender of this and has been very difficult for years to not do this especially if you work all the time or for yourself the concept of time and work gets skewed. It’s really important to really think about how much downtime is important as well as rest.

OK I will admit I am a huge offender of this and has been very difficult for years to not do this especially if you work all the time or for yourself the concept of time and work gets skewed. It’s really important to really think about how much downtime is important as well as rest. Entrepreneurs often swear by their caffeine fix, crediting it for their energy and focus. However, excessive caffeine consumption has its downsides.

Entrepreneurs often swear by their caffeine fix, crediting it for their energy and focus. However, excessive caffeine consumption has its downsides.

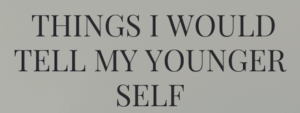

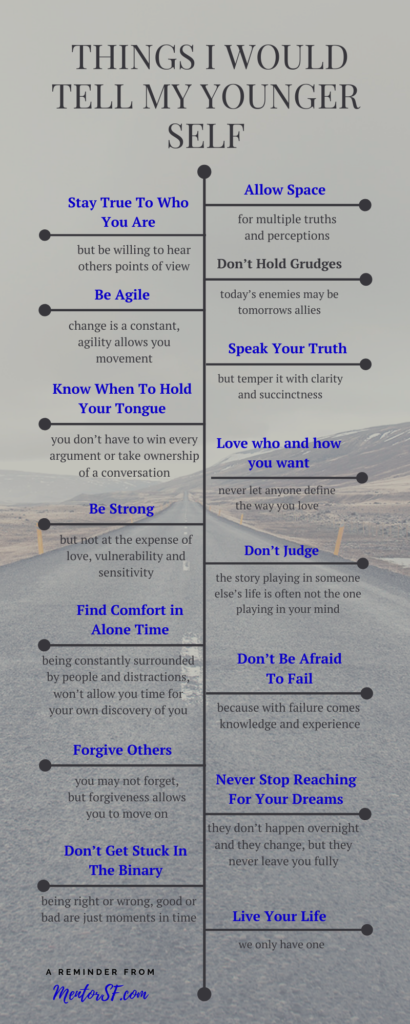

15 Things I Would Tell My Younger Self

15 Things I Would Tell My Younger Self